In case you missed it, getting a Really Big Diagnosis like, say, cancer, is a big whack to the wallet. Even if you have titanium-plated insurance (spoiler: there is no such animal in the US healthcare payment system), there will be bills for many, many things.

In case you missed it, getting a Really Big Diagnosis like, say, cancer, is a big whack to the wallet. Even if you have titanium-plated insurance (spoiler: there is no such animal in the US healthcare payment system), there will be bills for many, many things.

If you have a deductible, be prepared to build a spreadsheet matrix with complex algebra to calculate how much of what care will be on you. If you have co-insurance – your spouse’s employer coverage, for instance – that’ll add complexity to your algebra.

It’s a lot.

In a piece on the Discover credit card and financial services blog, recent Cancer Club inductee Kris Blackmon lays out how unexpected medical expenses impact people dealing with a Really Big Diagnosis, or any ongoing health issue that requires lots of clinical care – and therefore medical bills – offering a solid strategy for dealing with those bills.

Do your research

Talk to your clinical team’s billing office in advance about what your options are under your coverage plan. You’ll have to do this with each provider and facility you’ll receive care in – Blackmon says she chose to be treated at a major academic medical center because of the one-stop care coordination available in a comprehensive care setting.

Ask all the questions

If you’ve been hanging around these parts for any length of time, you know I’m all about being your own best advocate when getting medical treatment. Kris Blackmon puts mustard on that ball by recommending that, even if you wind up in the emergency department (which can totally happen during cancer treatment), you ask to speak to the billing department rep in the ED before any treatment is ordered, or delivered, so you know what your options are, and what the bill might be for them.

Read the fine print

Yeah, yeah, “nobody reads the Terms and Conditions,” but when you’re getting medical treatment … YOU GOTTA READ ‘EM, KIDS. Reading all of each bill, and lining it up with your health plan coverage, can unearth errors and fact-check the bills you need to pay to meet your deductible. By the way, did you ask if all the clinicians delivering your care were in-network in the previous section? If not … SURPRISE! And not the fun kind with confetti and cake, the not-fun kind with you being on the hook for their charges, thanks to something called balance billing.

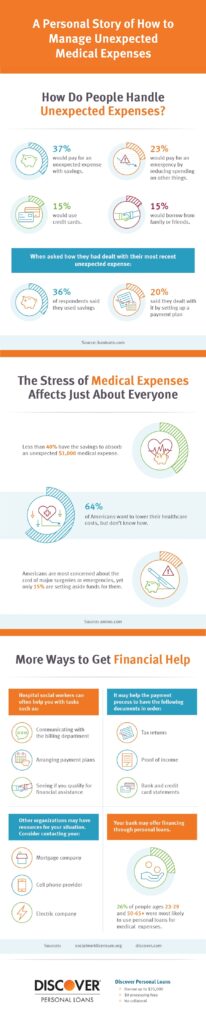

Think it’s just you? Nope. It’s all of us.

Social Workers and Other Organizations May Help You Manage Expenses

When I was dealing with my own Cancer Year, I not only served as my own care coordinator, I was also my own social worker – I was handed a resource sheet by my surgeon’s NP, and then worked the phones and web on my own behalf to find ways to pay the bills that were piling up, as well as the living expenses ditto. Cancer treatment is expensive, and it’s also exhausting – if you have to keep working (which I did) to keep the wheels on your life from falling off. Most hospitals and large health systems have social worker staff to help folks navigate resource options – use them!

What to do? Here’s how others managed.

There’s more!

I’ve shared the highlights of Kris Blackmon’s post on the Discover blog – read the whole thing here. Need some help? Reach out to me here. It takes a village to manage medical care – getting it AND paying for it. Happy to help if you need it.